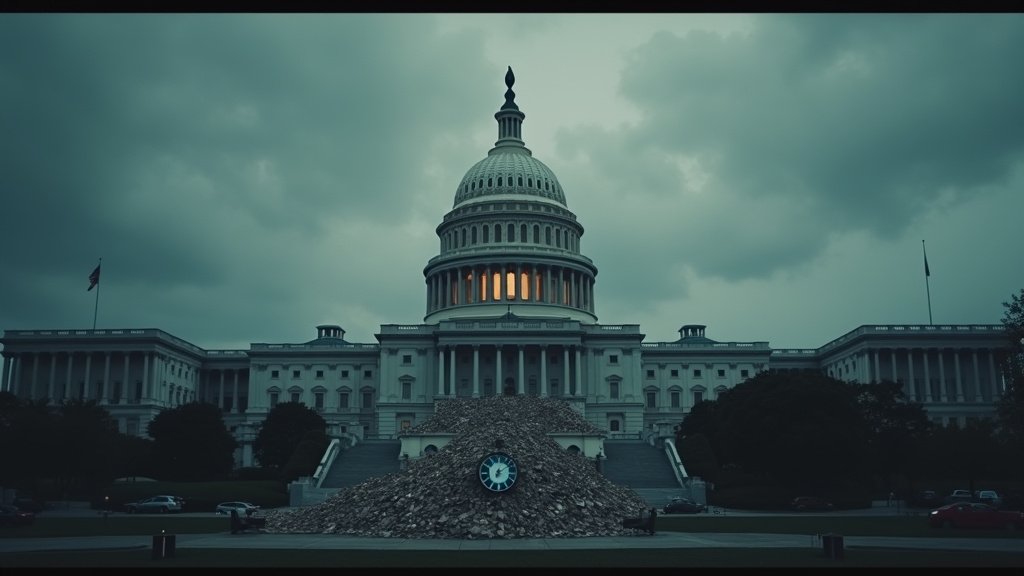

The question of how long Congress will continue to grapple with pervasive Fiscal Mismanagement looms large, with persistent budget deficits and a ballooning national debt signaling an unsustainable fiscal path. This ongoing issue not only impacts the economic future but also raises broader concerns about governmental accountability and the effectiveness of policy-making across various domains, illustrating the profound impact of Fiscal Mismanagement.

The Escalating Scale of Fiscal Mismanagement

The United States’ national debt has reached staggering proportions, exceeding the size of the economy itself and surpassing historic peaks set after World War II. As of recent assessments, the debt-to-GDP ratio stands at approximately 122 percent. This situation has been exacerbated by years of budget deficits, with significant increases attributed to legislative actions, including large spending packages. The economic consequences of such Fiscal Mismanagement are dire: continued reckless government spending without commensurate revenue generation could lead to prolonged economic stagnation or a catastrophic sovereign debt crisis. The nation now spends more on interest payments for its debt than on national defense, a stark indicator of fiscal strain and Fiscal Mismanagement.

A Broken Budget Process and Lacking Accountability in Fiscal Mismanagement

Contributing to this fiscal predicament is a dysfunctional congressional budget process. Deadlines for passing appropriations bills are routinely missed, leading to reliance on stopgap funding measures, known as continuing resolutions, to avert government shutdowns. This cycle of missed deadlines and last-minute fixes highlights a lack of transparency and accountability in how Congress manages public funds, a direct symptom of Fiscal Mismanagement. The process often prioritizes short-term political battles over long-term fiscal stability, focusing on a fraction of government spending while neglecting revenue streams. This makes it difficult for Congress to address structural imbalances between spending and revenue, creating an “unsustainable fiscal path”.

Economic Repercussions for Citizens from Fiscal Mismanagement

The tangible effects of this Fiscal Mismanagement are felt by everyday Americans. Rising national debt contributes to higher borrowing costs for individuals seeking loans for homes or cars, and for businesses needing capital for investment. This can lead to stagnant wage growth and more expensive goods and services, as businesses may invest less in productivity-enhancing technologies. Furthermore, the increasing cost of servicing the national debt crowds out crucial public investments in areas like infrastructure and research, which are vital for long-term economic growth and opportunities for future generations. There is also a palpable risk of a fiscal crisis, where a loss of confidence by creditors could trigger a severe economic downturn with far-reaching global repercussions, a common outcome of prolonged budget deficits and Fiscal Mismanagement.

Broader Concerns in Government and Policy Debates

Beyond the core fiscal issues, public discourse often includes commentary on other governmental actions and policy decisions that reflect on overall governance. For instance, in Texas, Governor Greg Abbott recently designated the Council on American-Islamic Relations (CAIR) and the Muslim Brotherhood as terrorist organizations. This move has been met with strong condemnation from CAIR, which denies the allegations and has initiated legal action, with some outlets noting a lack of federal evidence supporting the designation. Such policy pronouncements, often amplified through news and editorial discussions, draw scrutiny regarding the evidence base and potential political motivations.

Separately, recent Supreme Court rulings have continued to shape the intersection of religion and politics. Analyses suggest a trend of decisions favoring religious groups, particularly Christian organizations, prompting debate about the separation of church and state and the impact on minority rights. These discussions, often highlighted in various forms of public news and opinion, underscore the ongoing re-evaluation of legal and societal boundaries. While distinct from direct Fiscal Mismanagement, these controversies contribute to a broader conversation about governmental decision-making, accountability, and the evidence guiding policy.

The Unanswered Question Regarding Fiscal Mismanagement

The recurring patterns of budget deficits, escalating national debt, and a failing appropriations process paint a clear picture of fiscal challenge and Fiscal Mismanagement. The question remains not if these issues have consequences, but how long the nation will tolerate a system that consistently seems to prioritize short-term political expediency over long-term fiscal health. Without significant reform and a renewed commitment to responsible stewardship of taxpayer money, the economic and societal costs of this Fiscal Mismanagement will continue to mount, leaving future generations to bear an ever-heavier burden.