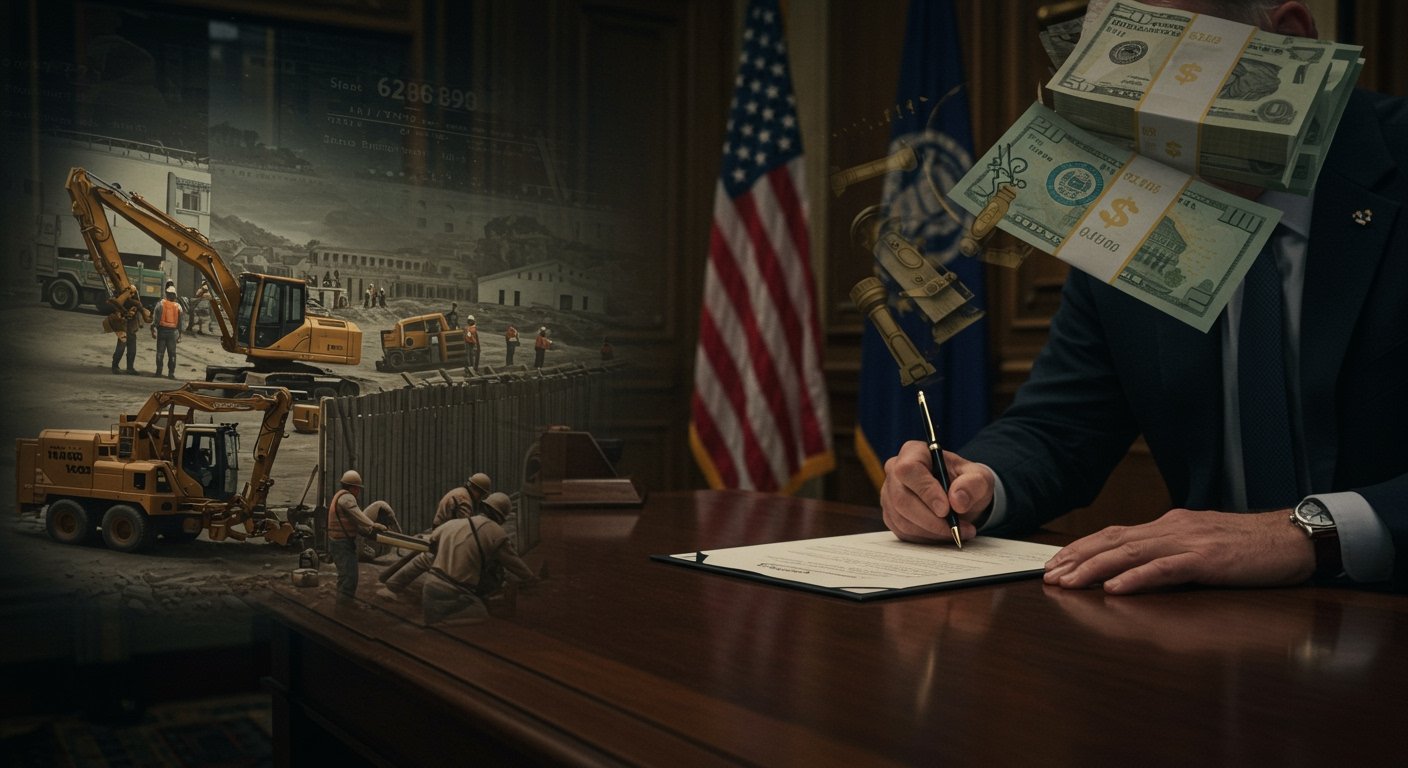

Trump Enacts Sweeping Legislation on July 4, 2025

President Donald Trump signed into law a sweeping legislative package, informally dubbed the “One Big Beautiful Bill,” on July 4, 2025. The enactment occurred the day after the measure narrowly cleared the Republican-controlled House of Representatives by a vote of 218-214. This comprehensive bill addresses a range of critical policy areas, including border security, taxation, and government spending, marking a significant legislative achievement for the administration and the Republican majority in Congress.

Components of the Landmark Bill

The “One Big Beautiful Bill” represents a broad legislative undertaking, integrating diverse policy objectives under a single statutory framework. Its core components include substantial investments in border and national security, provisions making the 2017 tax cuts permanent, and implementation of broad reductions in government spending across various sectors. The bill’s architects argue it is designed to secure the nation’s borders, stimulate economic growth through tax relief, and enhance fiscal responsibility through spending controls.

Border and National Security Provisions Detailed

A cornerstone of the legislation is a substantial $350 billion allocation dedicated to border and national security initiatives. Within this significant sum, the bill specifically earmarks $46 billion for the expansion of the physical barrier along the US-Mexico border, often referred to as the wall. Additionally, it allocates $45 billion for the establishment of 100,000 new migrant detention beds, significantly increasing the nation’s capacity for housing individuals apprehended at the border. The plan also provides funding for hiring a substantial number of new personnel for Immigration and Customs Enforcement (ICE), authorizing the addition of 10,000 new ICE officers. To incentivize recruitment, the legislation includes provisions for a $10,000 signing bonus for each new officer hired.

Fiscal Measures: Permanent Tax Cuts and Spending Reductions

Beyond security measures, the bill enacts significant changes to U.S. fiscal policy. A key provision makes permanent the individual and corporate tax reductions originally implemented under the 2017 Tax Cuts and Jobs Act. Supporters contend this will provide long-term certainty for businesses and taxpayers, fostering investment and economic stability. Concurrent with these tax provisions, the legislation mandates broad reductions in government spending across numerous agencies and programs. While the bill does not specify every line item reduced, the overall mandate is to achieve significant savings, intended to offset some of the fiscal impacts of the tax cuts and new spending.

Legislative Passage and Opposition

The bill’s path to enactment was marked by partisan division, particularly evident in the House vote. The final tally of 218-214 reflected a near-party-line split in the Republican-controlled chamber. All 212 Democrats present opposed the legislation, citing concerns over its priorities and potential consequences. Among Republicans, only two of the 220 House Republicans ultimately voted against the bill, highlighting strong party support despite the narrow margin of passage.

Criticisms and Projected Impacts

Despite its signing into law, the “One Big Beautiful Bill” has drawn significant criticism from various groups, primarily Democrats and policy analysts. Critics argue that the substantial spending directed towards border enforcement, particularly on detention facilities and staffing, could lead to millions of individuals losing access to essential services, including health coverage, as a result of the mandated broad spending reductions in other areas of the federal budget. Furthermore, a nonpartisan analysis of the bill’s combined fiscal effects projects that the plan, despite its spending cuts, will ultimately add over $3 trillion to the national debt over the next decade due to the permanence of the tax cuts and the magnitude of the new security spending.

Looking Ahead

The signing of the “One Big Beautiful Bill” into law on July 4, 2025, marks a significant moment for the Trump administration and the Republican agenda. While proponents hail it as a necessary step for national security and economic prosperity, opponents warn of potential social costs and significant increases to the national debt. The implementation of its wide-ranging provisions, from border wall construction to permanent tax rates and spending cuts, is expected to have profound and lasting impacts on the United States, setting the stage for continued political debate and policy adjustments in the years to come.